FFAI

World's First EV-RWA Protocol

FFAI

World's First EV-RWA Protocol

$FFAI

Tokenizing $500M EV Pre-orders

Innovative RWA protocol tokenizing electric vehicle assets

Every vehicle delivery directly drives token value growth

$500M

Pre-order Value

10,000+

Confirmed Reservations

Nasdaq

Listed Backing

FFAI

Real Asset Driven

FFAI

Real Asset Driven

Assets First

Tokens Follow

Not concept hype, but real assets on-chain

FX Super One has locked $500M in pre-order value

$3.53B

Total Funding

SPV Custody

Asset Isolation

Certik

Security Audit

FFAI

Deflationary Model

FFAI

Deflationary Model

Delivery = Burn

Value Keeps Growing

Every vehicle delivery → 5% revenue buyback & burn

Supply reduction + Asset pool expansion = Token appreciation

10B

Total Supply

5%

Buyback & Burn

20-50%

Staking APY

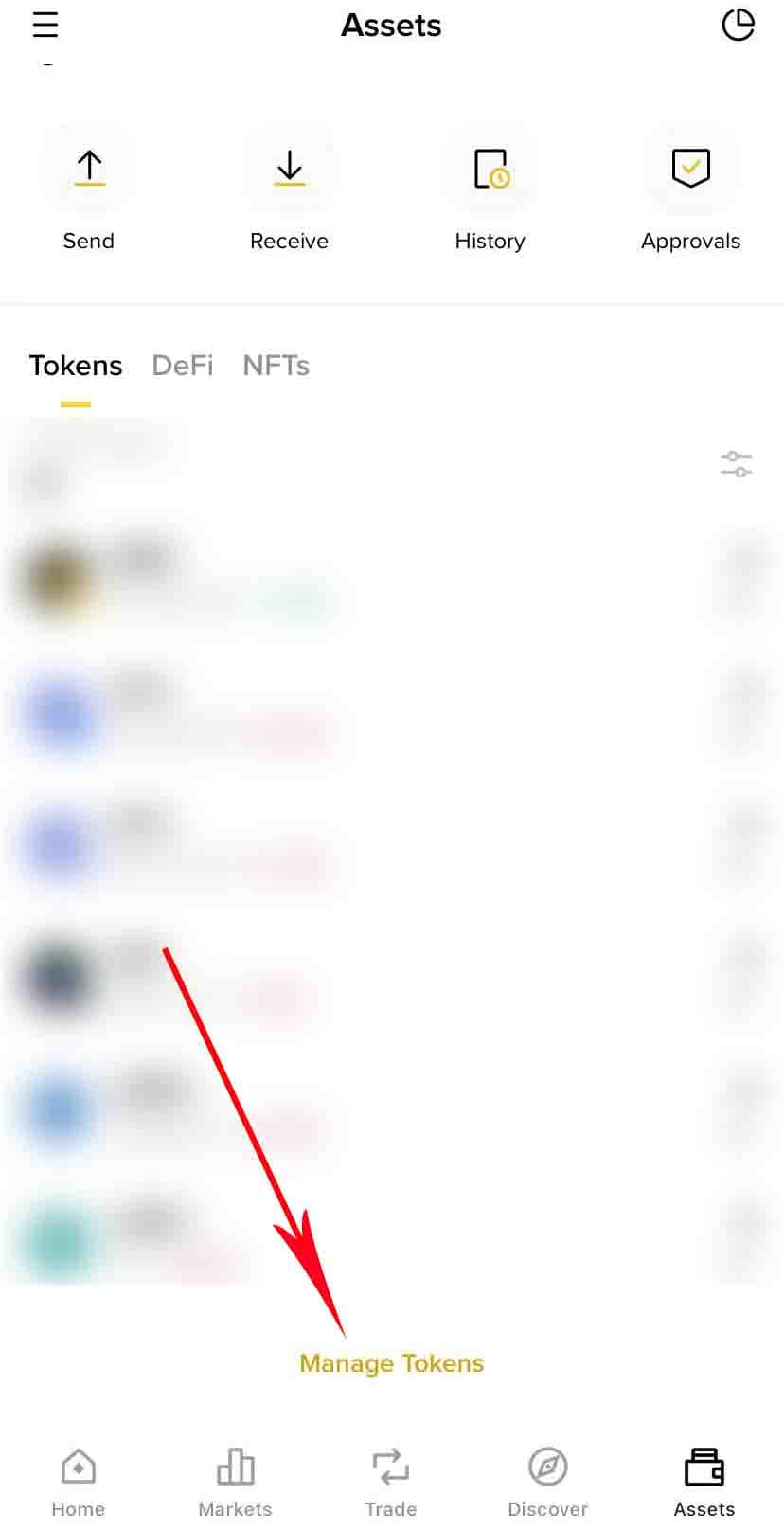

FFAI

Seed Round Now Open

FFAI

Seed Round Now Open

40-100x

Potential Return

Initial market cap $100M → 2027 target $10 Billion

BlackRock, Goldman Sachs, JPMorgan are fully positioned in RWA

Scroll Down